Ayala Land, Inc. (ALI) posted total revenues of P106.1 billion and a net income of P12.2 billion in 2021, a 10% and 40% growth, respectively, on account of resilient operations amidst the ongoing pandemic. Supported by relaxed quarantine restrictions in the fourth quarter, total revenues grew 2% to P33.5 billion, while net income increased 54% to P3.6 billion quarter-on-quarter.

Property development revenues grew 14% to P75.9 billion from construction progress and higher project bookings. Most of the revenue buildup commenced in the fourth quarter as it grew 40% to P24.4 billion from the third quarter. Sales reservations for the year reached P92.2 billion, a 13% growth from last year, mainly from solid demand for lots in Southern Luzon by Ayala Land Premier and Alveo. Sales reservations from lot sales alone jumped 36% to P41.5 billion during the year. In the fourth quarter, sales grew 5% to P22.1 billion from the same period in 2020. Reflecting confidence in the local residential market, ALI launched 22 projects worth P75.3 billion during the year, seven times more than in 2020. Meanwhile, commercial leasing revenues amounted to P20.6 billion, a 5% decline from a year ago as malls, hotels, and resort operations remained limited for most of the year. Shopping center revenues declined 13% to P7.9 billion, and hotel and resorts revenues decreased by 12% to P2.8 billion. Nevertheless, office leasing revenues increased 5% from 2020 to P9.9 billion as BPO and Corporate operations remained stable throughout the period. Relaxed restrictions in the fourth quarter translated into higher mobility and tenant sales which boosted commercial leasing revenues by 35% to P6.4 billion, primarily as shopping center revenues grew 101% to P3.0 billion from the previous quarter and 106% from the same quarter in 2020. Similarly, hotels and resorts revenues improved by 55% to P981 million from the third quarter of 2021 and 62% from the same period last year. Our focus in 2021 was to ensure we provided the right environment in our communities for our residents, businesses, and institutional locators to adapt and function better while executing our business recovery plans. As the economy moves to full reopening in 2022, we look forward to the acceleration of our business activity backed by our landbank, diversified portfolio, and market-leading estate developments,” said Bernard Vincent O. Dy, Ayala Land President and CEO. Ayala Land ended 2021 with a net debt-to-equity ratio of 0.77:1, an average borrowing cost of 4.4%, and maturity of 5.3 years as it actively managed debt to keep its balance sheet strong. Capital expenditures totaled P64.0 billion, wherein 52% was spent on residential projects, 17% on land acquisition, 15% on commercial projects, and 14% on estate development. In 2021, ALI also celebrated its 30th anniversary as a listed company on the Philippine Stock Exchange. The year also marked its merger with its listed subsidiaries Cebu Holdings, Inc. (CHI) and Cebu Property Ventures and Development Corporation (CPVDC) to consolidate value for its shareholders. Beyond this transition, the company’s presence in the bourse has progressively evolved with the listing of the country’s first REIT, AREIT, in 2020 and the continuing growth of AyalaLand Logistics Holdings, Corp. (ALLHC). The company also made significant progress in its community development and environmental sustainability initiatives. Its Alagang AyalaLand program has been making considerable headway in helping vulnerable social enterprises (SE) and small businesses recover from the pandemic. ALI launched the program in March 2021 to provide rent-free spaces to social enterprises in its malls. The program has helped at least 700 social enterprises that offer environmentally and socially sustainable products and has generated approximately 4,000 jobs. In 2021, emissions from Ayala Land’s commercial properties had been reduced and offset to achieve carbon neutrality status by shifting to renewable energy, nurturing carbon forests or carbon sinks in its landbank, and continuing energy efficiency measures. The achievement is subject to third-party verification scheduled this year. On top of this, its malls in Metro Manila segregate, measure, and collect clean and dry plastics. About 75 tons of plastics (equivalent to the clean and dry plastics generated in all its malls in Makati and BGC) were used for MDC’s ready-mix concrete and eco products for sidewalks and perimeter fences in its developments. In addition, Ayala Land signed up to support the Task Force on Climate-Related Financial Disclosures (TCFD) and engaged a third party to evaluate the impact of climate change risks on its business. ALI will incorporate the recommendations as part of its risk mitigation and operational resiliency measures in 2022. Last January 20, 2022, ALI likewise entered into a property-for-share swap with Ayala Corporation (AC) and Mermac. AC and Mermac will transfer five assets to ALI in exchange for 311,580,000 primary common shares at a value of P55.80 per share, totaling P17.4 billion. AC, ALI, and Mermac are targeting to complete the requirements within the year. AC has a 46.07% share in ALI. Once approved by regulatory bodies, AC’s ownership in ALI will increase to 47.20%. The properties are in key locations and will further expand ALI’s landbank and commercial assets and will potentially create value for ALI stakeholders.

Other Articles

Home Is Here With You

10/24/2023

ALI Welcomes Its First Female CEO

09/05/2023

Ayala Land to invest close to P90B for South Coast City

07/01/2021

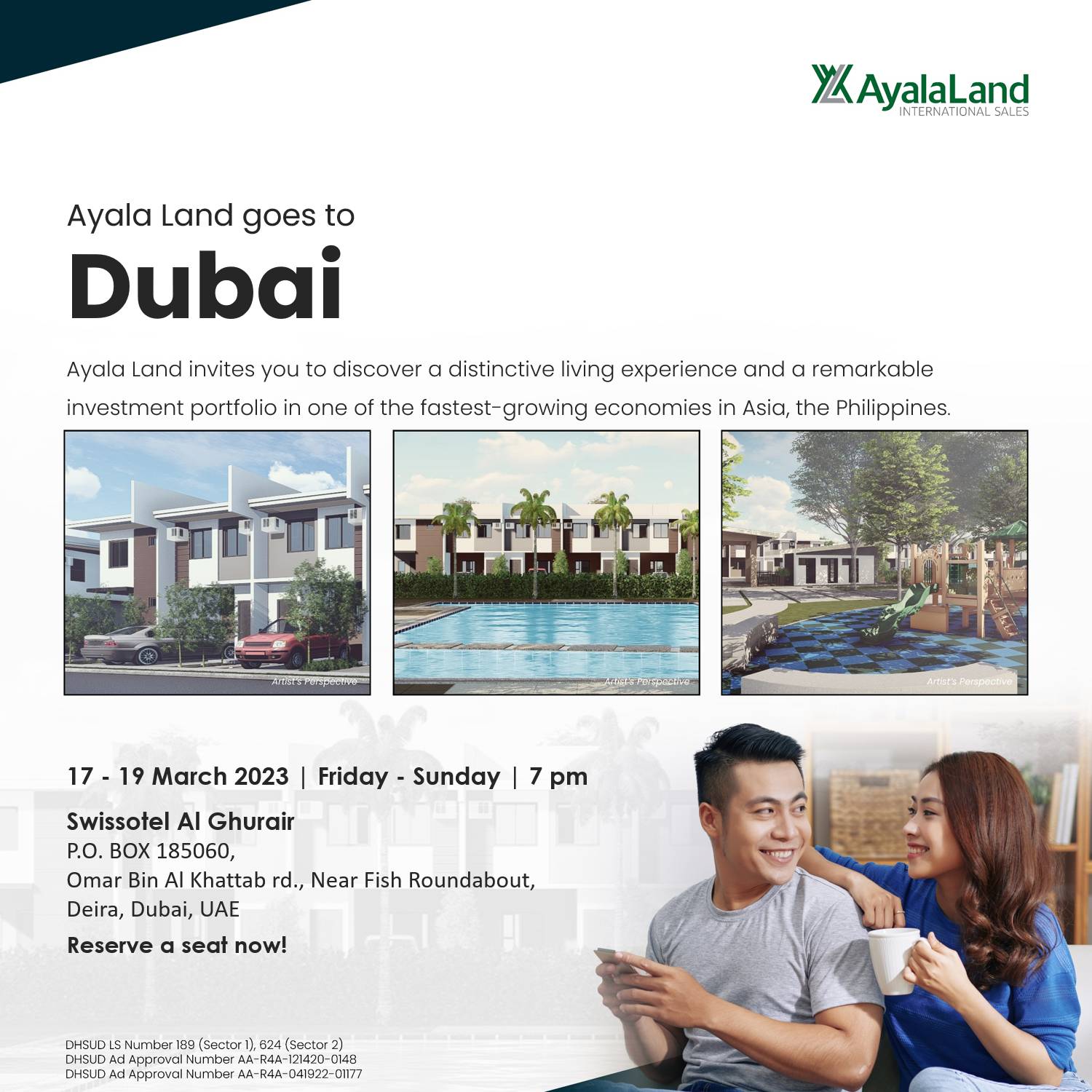

UAE becomes Ayala Land’s fastest growing international market with 157% revenue growth in 2022

03/22/2023

Ayala Land goes to Japan

03/15/2023

Ayala Land in Dubai and Abu Dhabi

03/15/2023

A Better Home, Back Home: Why Cebuanos Living Abroad Should Invest in Property in Their Hometown

03/14/2023

Hello, Home Kong: Ayala Land International Celebrates A Decade in the Island City

On-the-go communities fuel booming businesses in Ayala Land’s Vermosa Estate