AREIT, Inc. (AREIT), the first Philippine Real Estate Investment Trust, recorded revenues of P3.32 billion and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of P2.40 billion in 2021, 63% and 55% higher year-on-year, respectively, as a result of stable operations with a 98% occupancy and 98% rental collection rate.

AREIT, Inc. (AREIT), the first Philippine Real Estate Investment Trust, recorded revenues of P3.32 billion and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of P2.40 billion in 2021, 63% and 55% higher year-on-year, respectively, as a result of stable operations with a 98% occupancy and 98% rental collection rate.

The company’s full-year net income ended at P2.43 billion, inclusive of a net fair value change in investment properties of P165 million. Excluding the net fair value change in investment properties, net income registered at P2.27 billion, 56% higher than the net income before the net change in fair value, and a one-time deferred tax of P1.45 billion in 2020. Last February 24, 2022, AREIT’s Board of Directors approved the declaration of dividends of P0.47 per share for the fourth quarter of 2021 to be distributed on March 25, 2022, to stockholders on record as of March 11, 2022. The company’s full-year dividends from its 2021 income totaled P1.77 per share, a 34% increase from 2020 and 12% higher than its REIT plan projection during the IPO due to asset acquisitions last year. In 2021, the company purchased The 30th, a 75 thousand sqm commercial development located in Pasig City, and 98 thousand sqm of land at Laguna Technopark leased by Integrated Micro-Electronics, Inc. It also secured the Securities and Exchange Commission’s (SEC) approval for a property-for-share swap with Ayala Land, Inc. (ALI) and its subsidiaries, Westview Commercial Ventures Corp. and Glensworth Development, Inc., in exchange for properties such as Vertis North Office Towers and Mall, Ayala Life FGU Office Condo Units in Makati and Alabang, One and Two Evotech BPO Buildings in Nuvali, and Bacolod Capitol, and Ayala Northpoint BPO Buildings in Negros Occidental. The recognition of income from the new assets accrued beginning October 01, 2021. AREIT ended 2021 with a total GLA of 549 thousand and an AUM of P53 billion. Last December 2021, AREIT listed its maiden bond offering of P3 billion with a two-year tenor and a fixed rate of 3.04% per annum. The bond is the only two-year tenor issue in 2021 and received overwhelming interest from local bond investors as it was 5.6 times subscribed. The bonds represent the first tranche of debt securities issued under AREIT’s P15 billion Debt Securities Program registered with the SEC. The Bonds have been rated PRS Aaa by PhilRatings. AREIT is the first Philippine REIT to offer a bond to the public and list it in the PDEx. AREIT also disclosed its new three-year strategy, indicating its plans to reach P60 billion in AUM by 2022 and grow its asset portfolio at an average of 100,000 sqm of GLA in 2023 and 2024, translating to an increase of P10-15 billion in its AUM annually during the period. The company maintains its thrust to grow and diversify its asset portfolio by sector, location, and income contribution and achieve a total shareholder return range of 10-12%. The company closed the year with a solid balance sheet with a net gearing of 0.08:1. The company was awarded Most Outstanding IPO in the Philippines by Asiamoney in its 2021 Asia’s Outstanding Companies Poll. AREIT also became the first Philippine REIT included in the FTSE EPRA Nareit Asia ex-Japan REITs 10% capped Index. It is also a constituent of the MSCI Philippine Small Cap Index, and it became part of the FTSE Small Cap Index and the Philippine Property Index this month. AREIT successfully neutralized its Scope 1 and 2 carbon emissions in 2021 and is moving towards Scope 3 and net zero emissions from operations of its existing buildings by the end of 2022.

Other Articles

Home Is Here With You

10/24/2023

ALI Welcomes Its First Female CEO

09/05/2023

Ayala Land to invest close to P90B for South Coast City

07/01/2021

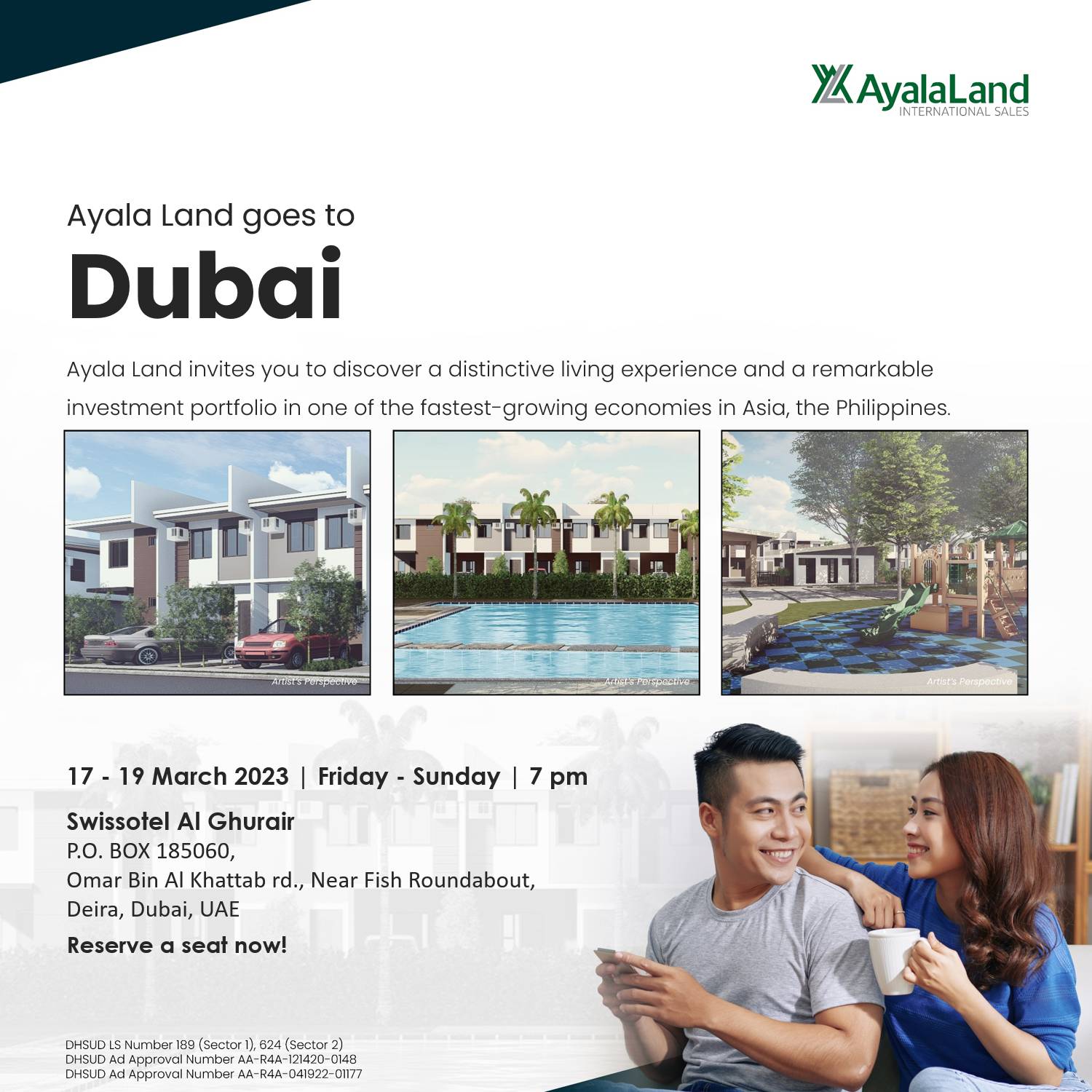

UAE becomes Ayala Land’s fastest growing international market with 157% revenue growth in 2022

03/22/2023

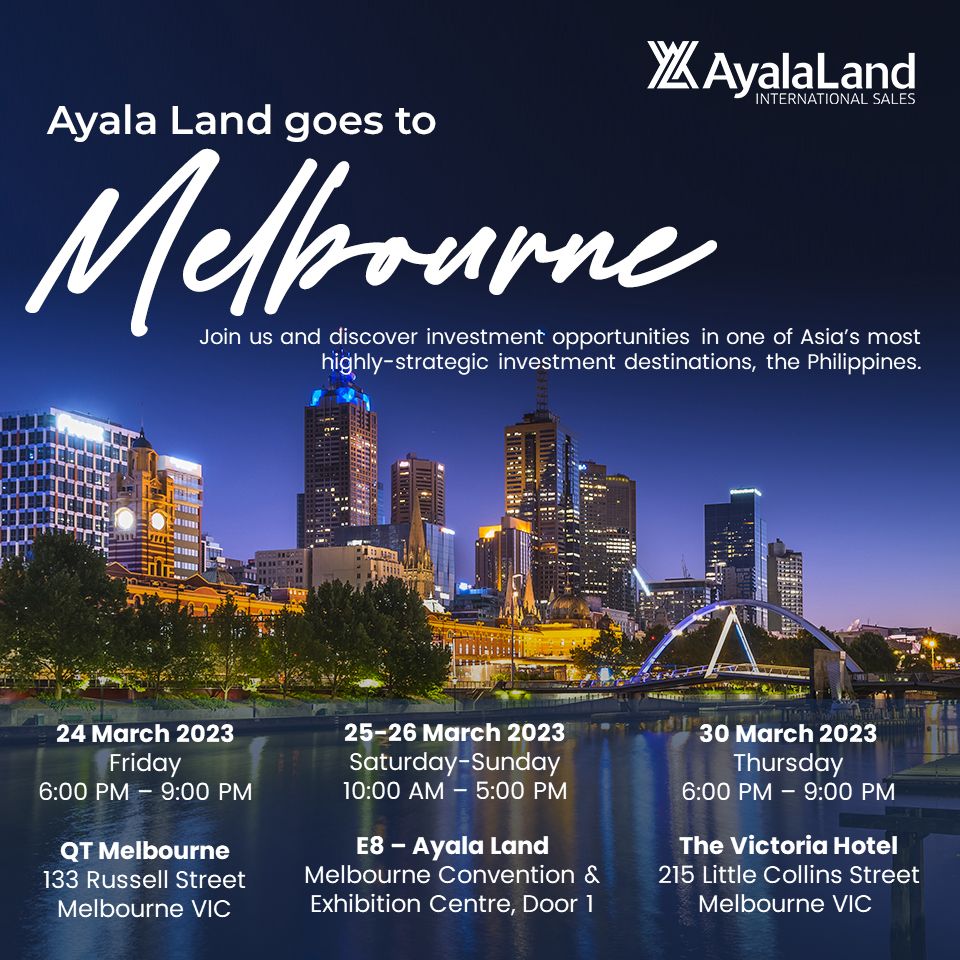

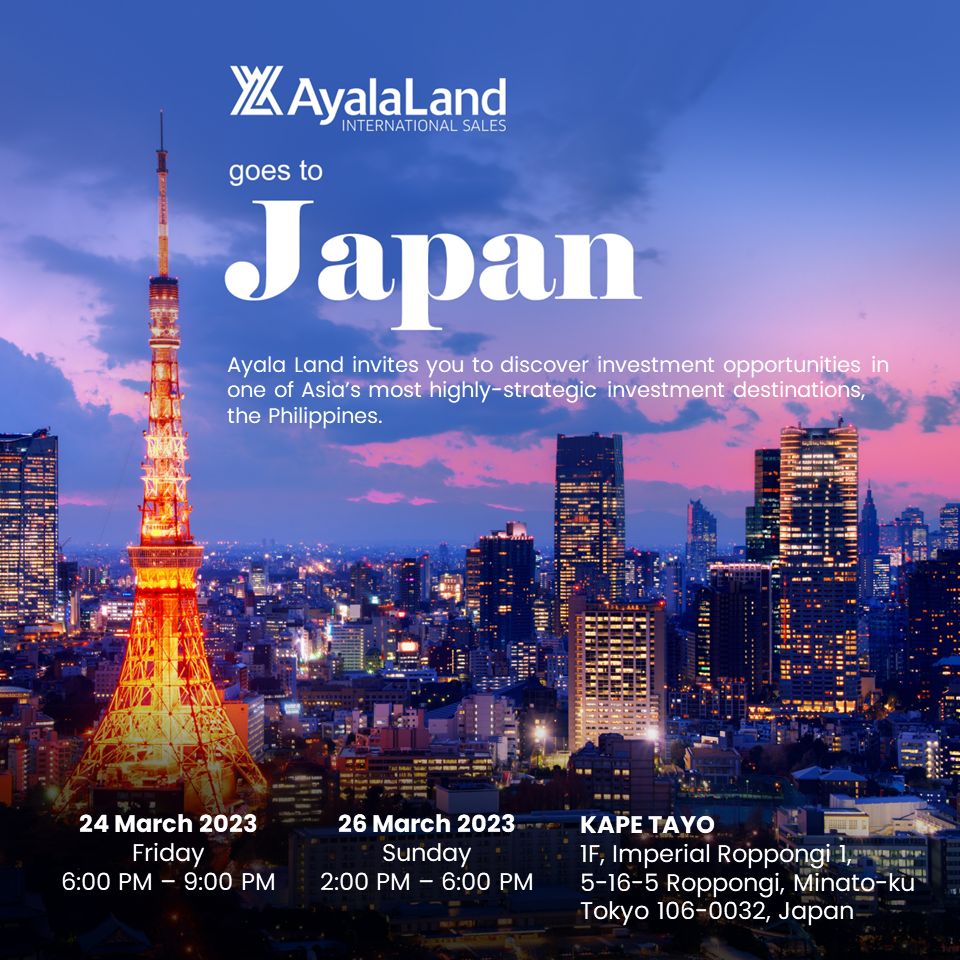

Ayala Land goes to Japan

03/15/2023

Ayala Land in Dubai and Abu Dhabi

03/15/2023

A Better Home, Back Home: Why Cebuanos Living Abroad Should Invest in Property in Their Hometown

03/14/2023

Hello, Home Kong: Ayala Land International Celebrates A Decade in the Island City

On-the-go communities fuel booming businesses in Ayala Land’s Vermosa Estate